Skye at Holland, Penrith, Faber Residence, Zyon Grand, The Sen | Which Will Lose Money?

When it comes to Singapore’s Core Central Region (CCR), the prevailing belief has always been that land prices—and by extension, property prices—only move upward over time. But what if we told you that land bids in CCR districts 9, 10, and 11 haven’t risen since 2018, and in fact, have actually fallen?

This unexpected trend sets the stage for Skye @ Holland, one of the most highly anticipated launches in 2025. In this article, we’ll dive into the land bid dynamics, market conditions, unit mix, location advantages, and pricing strategy to evaluate whether Skye @ Holland can replicate the success of recent CCR bestsellers like River Green and Lyndenwoods.

Land Bids: Why CCR Prices Fell Instead of Rising

Looking back at 2018, land bids for prominent CCR sites painted a picture of strength:

Haus on Handy (99-year leasehold) – $1,722 psf (Feb 2018)

Riveria Point (now Iveria, freehold) – $1,461 psf

Cairnhill Mansions (now Klimt, freehold) – $2,311 psf

Hollandia (now Hyll on Holland, freehold) – $1,703 psf

Toho Mansion (now Van Holland, freehold) – $1,805 psf

Pacific Mansion (now Avenir, freehold) – $1,806 psf

Even leasehold projects in CCR were transacting above $1,500 psf, with One Holland Village Residences at $1,888 psf and Irwell Hill Residences at $1,515 psf. The peak came with Cuscaden Reserve at a record $2,377 psf.

Fast forward to recent years, however, and the story has shifted:

Skye @ Holland – $1,285 psf

River Green – $1,325 psf

River Valley Green Parcel B – $1,420 psf

Dunearn Road GLS – $1,410 psf

Holland Link – $1,432 psf

Instead of climbing higher, land bids have actually dropped. Why?

Two main reasons:

Gross Floor Area (GFA) Harmonization (2022): Developers can no longer sell certain strata areas like aircon ledges, reducing the value they can extract from projects. This forced them to lower land bids.

Rising Construction Costs & Weak CCR Demand: Developers grew more conservative as sell-out rates slowed, particularly in CCR. With high unsold supply, they adjusted bids downward to reduce risk.

Interestingly, today’s CCR land prices are on par with or even cheaper than some RCR (Rest of Central Region) sites—an unusual reversal in the property market.

Development Details

Project Name: Skye at Holland

Tenure: 99 Years Leasehold

District: District 10

Address: 2 Holland Village Way, Singapore 279035

Site Area: 100,032 sqft | 3.5 Plot Ratio

No. of Units: 666 Residential Units

No. of Storeys: 40

Residential Units: From 2-Bedroom to 5-Bedroom

Skye @ Holland: Project Overview

Skye @ Holland sits on a prime 133,000 sqft site less than a 5-minute walk from Holland Village MRT. Developed as a two-block, 40-storey project with 666 units, it stands out as one of the rare full-facility CCR developments offering a 100% carpark ratio.

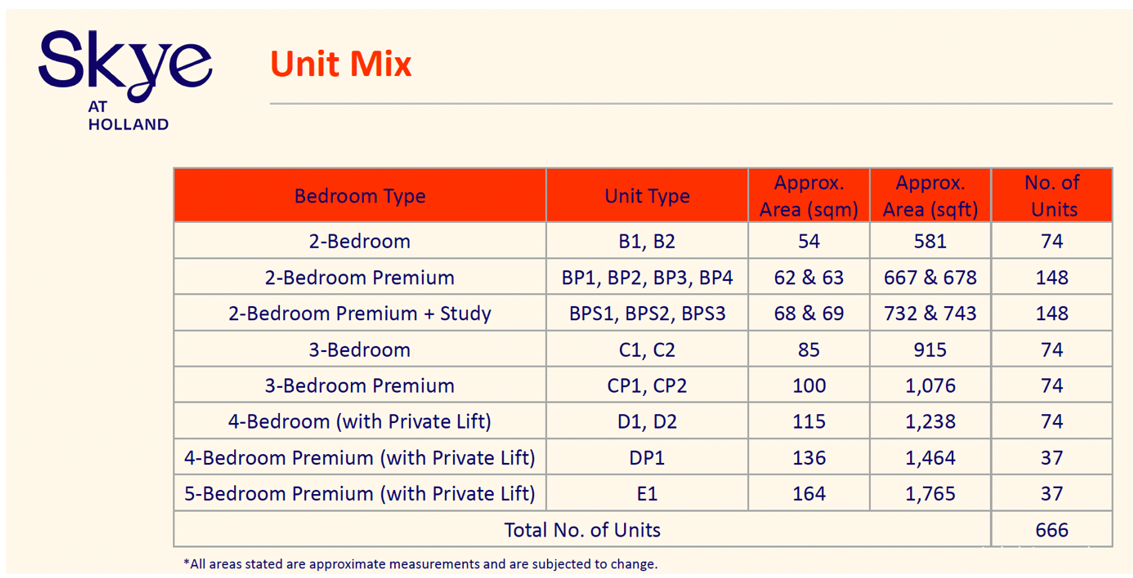

Unit Mix & Layouts

2-Bedders: 581–678 sqft

2 + Study: 743 sqft

3-Bedders: 915–1,076 sqft

4-Bedders: 1,238–1,464 sqft

5-Bedders: 1,765 sqft

With 45% of units as 3-bedroom or larger, the project emphasizes liveability over micro-investment units. The layouts, designed post-GFA harmonization, are efficient and slightly larger than competing projects, offering good value in today’s market.

Facilities & Views

Facilities include a 50m lap pool, yoga room, leisure pool, BBQ pavilions, pet corner, and a 500sqm clubhouse. Higher floors will enjoy unblocked views of the Botanic Gardens and the low-rise Holland Rise GCB area, though some inner-facing units will experience closer block-to-block spacing at around 31m.

Location Advantages

Holland Village remains one of Singapore’s most desirable addresses, blending upscale dining with authentic hawker centres. Residents will enjoy:

MRT Access: Less than 5 minutes to Holland Village MRT, with Buona Vista MRT also nearby.

Amenities: Multiple supermarkets (Cold Storage, FairPrice Finest, NTUC), hawker centres, and Star Vista mall within walking distance.

Lifestyle: Cafés, shophouse dining, and a strong community vibe unique to Holland V

Pricing Strategy: Why Skye @ Holland Stands Out

At $1,285 psf ppr, Skye @ Holland is the lowest-priced CCR GLS plot since 2019.

Indicative pricing suggests:

2-Bedders: From $1.6M to $2.5M

3-Bedders: $2.5M to $3.6M

4-Bedders: $3.5M to ~$5M

5-Bedders: From $5M upwards

Compared to One Holland Village Residences, Skye is highly competitive. For example, OHV’s 2-bed 1-bath (689 sqft) units have transacted between $1.6M and $2.0M, similar to Skye’s smaller 2-bedders—despite OHV being an older launch with less efficient layouts.

Subsale data shows OHV’s 3-bedders reaching up to $5.1M, while similar-sized Skye units are priced significantly lower. Even larger 4- and 5-bedder Skye units undercut OHV’s $6M–$11M range, further cementing its value proposition.

Exit Strategy & Profitability

Surrounding resale projects like Hyll on Holland, Parvis, and Marbella demonstrate healthy annualized profitability of 3–4%, even after long holding periods. Skye’s pricing, being lower than both resale medians and new launches nearby, creates a cushion for future capital appreciation.

With only 714 private residential units within 500m, Skye enjoys lower density compared to areas like Clementi (1,600+ units). Its proximity to Good Class Bungalow enclaves enhances its exclusivity.

Future demand is expected from:

Million-dollar HDB upgraders (from nearby BTO clusters)

Landed property downgraders seeking convenience

Older condo owners refreshing their portfolios

Downsides to Consider

Traffic congestion around Holland Village Way and North Buona Vista Road during peak hours.

Limited proximity to top schools within 1km.

Competition from cheaper RCR launches just 10 minutes away.

Closer block spacing for some inner-facing units.

Will Skye @ Holland Sell Out?

Skye @ Holland combines the rarest ingredients in today’s CCR market: a post-GFA harmonized development with efficient layouts, full facilities, a prime MRT location, and highly competitive pricing.

While some road noise and nearby RCR competition may be minor drawbacks, the project’s fundamentals—particularly its low land bid cost, strong location, and attractive quantum pricing—position it as a compelling choice for both own-stay buyers and investors.

Pros

Reputable developer with full facilities

100% carpark ratio

Competitive pricing vs CCR and RCR

Efficient post-GFA harmonized layouts

Walking distance to MRT and amenities

Strong resale and rental demand potential

Cons

Traffic and road noise

Not within 1km of top schools

Competition from RCR projects

Some inner-facing units with closer block spacing

With CCR land bids falling and Skye @ Holland priced strategically below both resale and new launch benchmarks, this could be one of the most attractive buying opportunities in the CCR in recent years.